This post is an honest review of 12% Club by BharatPe which promises 12% annual returns on the investment.

In today’s world, people are constantly seeking new ways to invest their money and earn more. One such option is the 12% Club app, which has been making waves in the Indian market. The app promises to provide investors with high returns and borrowers with easy access to loans.

In this article, we will provide an in-depth analysis of the 12% Club app, its founders, ROI, and the safety measures it has in place to protect investors’ and borrowers’ interests. So let’s start.

Jump To ⇢

What is Bharatpe 12% Club?

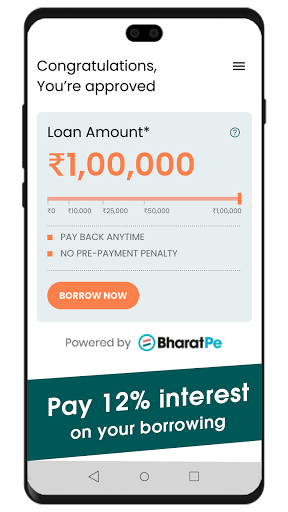

BharatPe 12% Club is a P2P lending service that claims that the users earn 12% interest on savings and can borrow at the same interest rate. The app, which claims to partner with RBI-approved NBFCs, provides collateral-free loans of up to Rs 10 lakhs for three months.

12% Club managed under BharatPe which is founded by Ashneer Grover and Shashvat Nakrani. The CEO of the company is Suhail Sameer who recently left his position. The 12% club has over 1 million downloads on the Google Play Store and the app is also rated in the top 30 in finance on Apple App Store.

Twelve.club is the official website of 12% Club and the site footer mentions that 12% Club is partnered with Hindon, LiquidFunds, and LenDen. All these are registered entities under MCA. It makes 12% Club as a credible lending and borrowing platform.

Read: CCBP 4.0 Review:

12% Club Investment

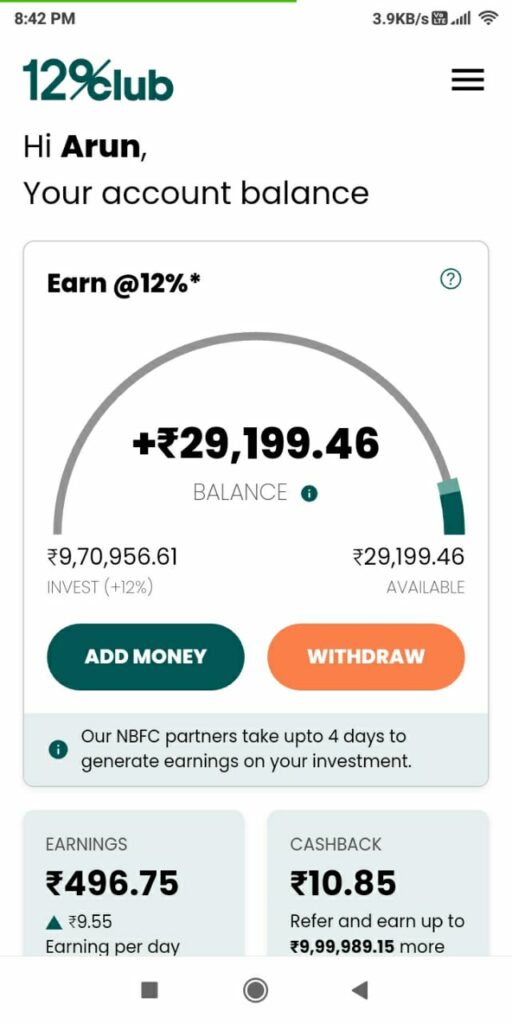

According to information by using the ‘12% Club’ app, consumers have the option to invest their funds at any time by lending money to BharatPe’s partner P2P NBFCs.

Additionally, consumers can also obtain unsecured loans up to Rs. 10 lakhs for a duration of three months through the ‘12% Club’ app at their convenience.

In starting, Users can start from Rs 10,000 and can invest up to 1 lakh rupees in the app, and the limit can be increased further.

On average, the app gives 12% returns per annum on the investment. As per calculations, normally on an amount of Rs 1 Lakh, the app gives a profit of Rs 990 monthly. This is a far better returns compared to bank interest and double of an FD.

But it also involves risk which is discussed ahead.

Read: Rupee4Click Review

12% Club Loan

The 12% Club app offers no-collateral loans up to Rs. 10 lakhs for a period of three months.

Users can apply for the loan directly through the app, and the eligibility criteria are based on the user’s credit score, shopping history, and any payments made through the BharatPe QR code. The loan does not charge any processing fee or pre-payment charges.

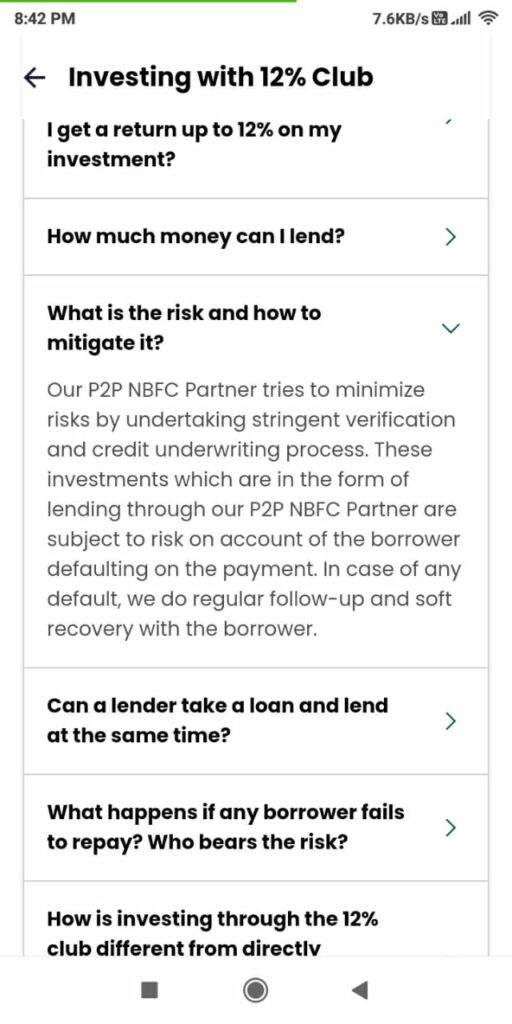

According to the platform, they strive to minimize risks by conducting strict verification and credit underwriting processes with our P2P NBFC partner. However, peer-to-peer lending is unsecured, and despite rigorous processes, it cannot be guaranteed risk-free returns or no defaults. Nevertheless, There is a soft recovery and collection process in place to ensure minimal defaults.

To minimize the risk, BharaPe shared a way through which are very few risks.

In the event of a borrower default, the pool of investors who funded the loan may be impacted.

For instance, if anyone invested ₹3,000 in 100 different loans, and one borrower defaults, the potential loss is ₹30. Since multiple lenders invest in multiple borrowers, a ₹3,000 loan would have several investors, and if the loan defaults, all of them could lose their built-in buffer.

Through this method, they claim that their app is 100% safe to invest in.

Read: PLC Ultima Review

Refer & Earn

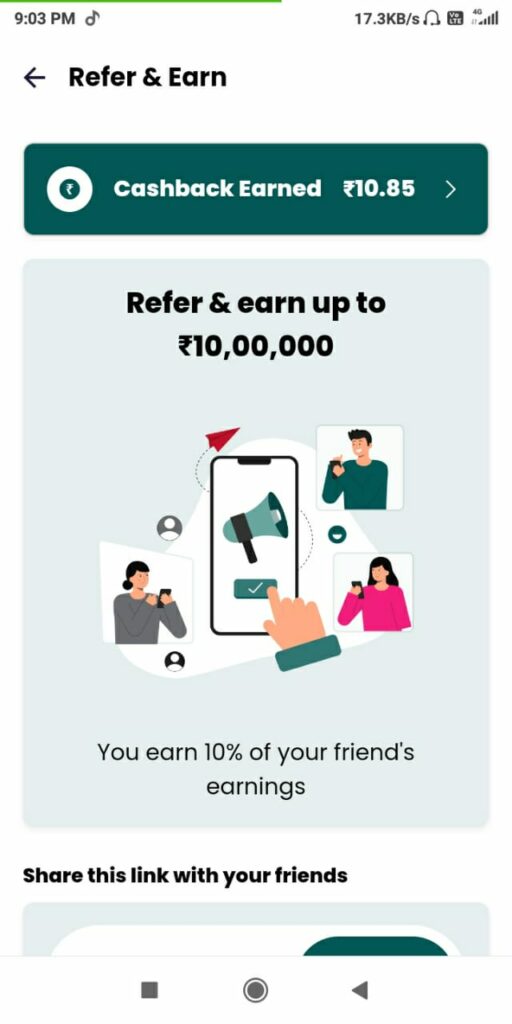

There are many influencers and people on the internet who are promoting 12% Club by BharatPe and the biggest reason is referral commission.

The 12% Club offers a way to earn from the refer-and-earn scheme where you can earn a 10% cashback on your friend’s earnings, which will be credited to your account every month.

To participate, access the menu in the top right corner of the 12% Club app, select “Refer and Earn,” and copy your unique referral code. Share it with your friends to enjoy maximum benefits.

Read: Forsage BUSD Review

12% Club Review

So, that’s it for the information, let’s start reviewing the 12% Club and check whether it is safe or not.

Is 12% Club Safe or Not?

The safety of the 12% Club app depends on various factors, including the creditworthiness of borrowers and risk management strategies employed by the P2P NBFCs partnered with BharatPe.

As a peer-to-peer lending platform, the 12% Club app connects investors with borrowers through the partner P2P NBFCs, and the investors earn interest on the funds they lend.

The app claims up to 12% interest returns on investments, but this rate is not guaranteed, and investors must bear the risk of borrower defaults.

Risk With P2P Lending Platform

12% Club is a P2P Lending Platform where investors are paid profit from interest gained via borrowing. Now, most of the borrowers of such platforms have no collateral and many are declined by banks for loans. In such cases, the rate of default is at higher sides.

Conserdering 12% Club as a platform has positive reviews. 12% Club app rated 4.1 stars from 23k users. Also, many investors shared screenshots of daily returns they earned without any withdrawal issues.

Should I Invest in 12% Club?

Although the P2P system can be a little risky, according to some experts the system made by BharatPe is so advanced that there are negligible chances of losing money.

Also, BharatPe has partnered with some experienced and reliable ventures in the industry.

However, as with any investment or lending activity, there is always an inherent risk involved. Borrowers may default, economic conditions may change, and unforeseeable circumstances may arise. As such, investors should exercise caution and thoroughly research the platform and its partners before investing any funds.

Read: AWPL Review

Visitor Rating: 5 Stars

No issue with 12 percent club.

I have Invested 50 lacs from 5 different accounts of my family members. I am getting an interest of 50000/- per month.

What % of your total investments you invest with 12% club ?