Quick Facts

- My Forex Funds has disclosed crucial details on its website and provide customer support.

- Some users have reported withdrawal issues, with difficulty accessing accounts or funds not being paid due to targets not being met.

- Slippage has also been a problem, affecting traders’ ability to meet targets.

My Forex Funds is a proprietary (prop) trading firm. It markets itself with the quote “Our Capital. Your Expertise.”

MyForexFunds.com works with the tagline “Your Success is Our Business”.

This post is going to be an impartial My Forex Funds review. Here we will go through different aspects, such as My Forex Funds Rules, Company Profile, Trading Accounts, Referral Bonus, My Forex Funds Vs FTMO and followed by our personal opinion on it.

You will also get an answer to the question: Should I join My Forex Funds?

| Founder | Murtuza Kazmi |

| When Started | 2020 |

| Head Office | Toronto, Canada |

| Products | Trading Account Memberships |

| Website | Myforexfunds.com |

| Joining Cost | $99 |

Jump To ⇢

What is My Forex Funds?

My Forex Funds, MFF is a proprietary trading firm. A proprietary firm is the one that allows users to deal in forex with the company’s capital, i.e. you can do trading on funds of MFF and earn profit.

MFF is started in the year 2020 in Toronto, Canada by Murtuza Kazmi (CEO). The company headquarters is still located in Toronto, Canada.

MFF’s official website is operated by Traders Global Group Incorporated.

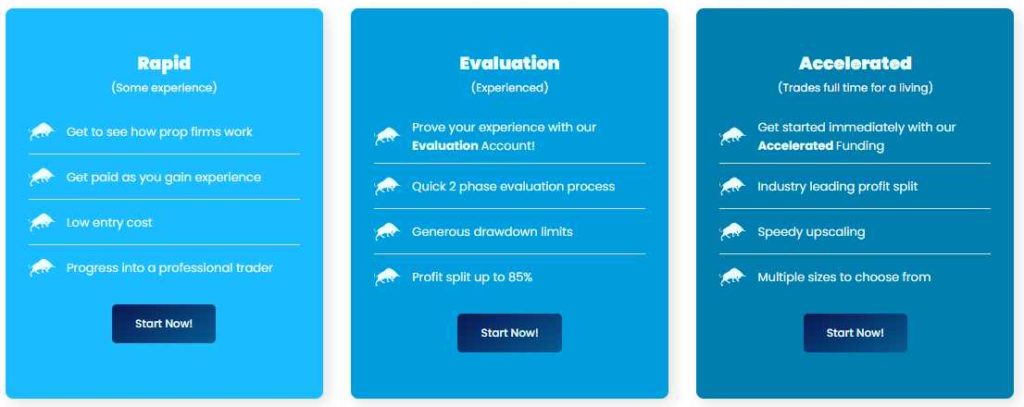

At first, it started with only one account type: Rapid Account. Later it added two more trading account types: Evaluation Account and Accelerated Account.

My Forex Funds allows users to trade through the electronic trading platform Meta Trader. It claims to support both MT4 and MT5.

According to Similarweb.com, major traffic to myforexfunds.com is from the USA (15.21%), Vietnam (5.77%), Nigeria (4.79%), Spain (4.17%) and UK (3.87%).

As of now when the post is written, the company has 1,80,000+ active traders from 150+ countries.

Read: Juicy Fields Review

Joining My Forex Funds

It takes a few easy steps to join My Forex Funds. Depending on the experience level, you need to select the appropriate trading account type from the following:

1. Rapid Trading Account

The rapid trading account is for users who have zero or minimal experience in trading. In this type of account, the traders can trade from the demo account and earn profit bonuses in their real account.

Depending on the type of plan you select the registration fee ranges from $99 to $749.

2. Evaluation Trading Account

This type of trading account is for professional traders. Here two-phase evaluation is followed with a phase 1 target of 8% and a phase 2 target of 5%.

The profit earned is split up and the traders earn a specified percentage of the profit.

Depending on the selected plan type, the refundable registration fee ranges from $49 to $1389.

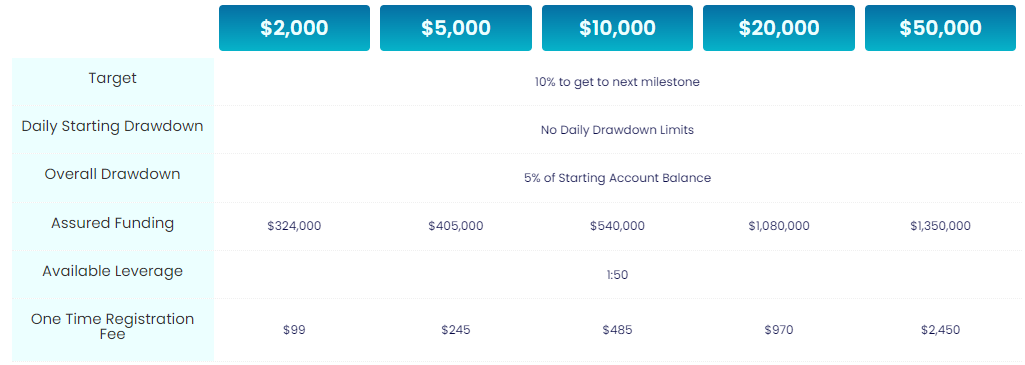

3. Accelerated Trading Account

This type of account is for experienced traders who wish to start earning instantly. In this type of account, the decided percentage of profit is instantly given to the traders.

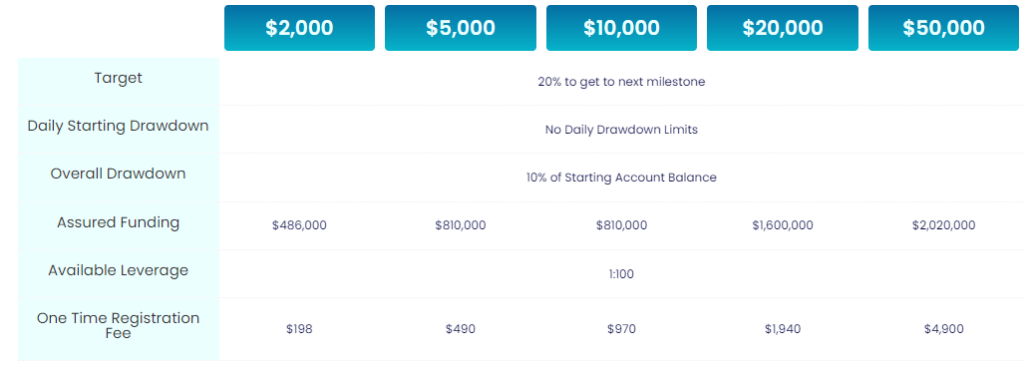

Two different accelerated plans are provided: Conventional and Emphatic.

In Conventional Plan the one-time registration fee ranges from $99 to $2450.

In the Emphatic Plan, the one-time registration fee ranges from $198 to $4900.

However, there are some criteria that need to be followed by every user.

For rapid and evaluation trading accounts, the daily dropdown limit is set to 5%. i.e. if the value of your account goes beyond 5%, your account violates the drawdown rules of the company.

Example: If you opt for $20,000 limit, 5% of 20,000 is $1000. Hence if your account value goes below $19000 (20,000-1000), it violates the drawdown rules of the company.

For accelerated accounts, there is no daily drawdown limit, however, you need to take care of the overall drawdown limit which is 5% for Conventional Plan and 10% for the Emphatic plan.

Read: iHub Global Review

My Forex Funds Profit Sharing

The profit-sharing percentage between Traders and MFF differs according to the selected type of trading account.

Profit can be withdrawn through bank transfer, Paypal payout or get exchanged in cryptocurrency.

| Account Type | Minimum Trading Days (Weekly) | % of Profit |

| Rapid Account | 3 days | 12% |

| Evaluation Account | 5 days | 75% – First month 80% – Second month 85% – Third month |

| Accelerated Account | – | 50% |

My Forex Funds Referral Commission

My Forex Funds also offers referral commission, but only on Rapid Account.

- For the first five referrals (1-5), the commission is 5% of purchases.

- For next five referrals (6-10), the commission is 10% of purchases.

- After 10 referrals (10+), the commission is 15% of every purchase made.

Read: Rodan+Fields Review

MyForexFunds Review

Finally, it’s time to share our personal review regarding My Forex Funds.

My Forex Funds has disclosed different crucial detail on its official website. Also, they have a support team available to solve doubts and problems.

However, all the glitters is not gold. As the company claims its positive existence, we tried to examine users’ experience on the same and came across the below points.

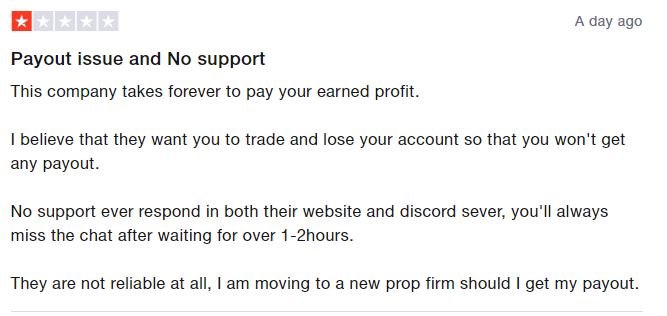

Withdrawal Issues

On Trustpilot.com, 5000+ users rated MyForexFunds 4.9 stars out of 5, which is impressive. But few reviews reveal some severe problems with MyForexFunds.

Users have made complaints regarding the withdrawal issues they face. Even after having multiple withdrawal mediums, people are unable to withdraw their earnings due to company or server problems.

A few comments disclose that the company is refusing to pay money by stating that the targets or limits are not achieved. While some have not received login credentials and they cannot access their account.

Fractions of these negative feedback are very less, but they are worth considering before becoming part of it.

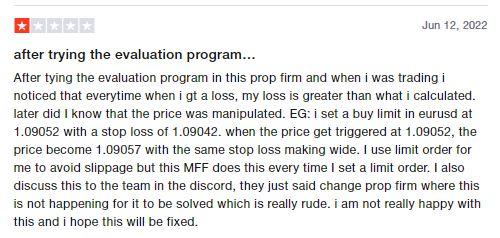

The Slippage Problem

The most discussed problem with MyForexFunds is Slippage. Slippage is a common phenomenon in trading. But in MyForexFunds, it adversely affecting traders and they miss targets cause of this.

Even in MyForexFunds demo accounts, users encounter slippage problems, which is frustrating for beginners.

Is MyForexFunds Legit or Scam?

There are no red flags or strong evidence which proves My Forex Funds is a scam.

My Forex Funds is a prop trading company that allows traders to complete challenges and earn profit.

It has its own policy, account types, dropdown limits, and other rules to follow. While My Forex Funds have some complaints and problems to tackle.

FTMO Vs MyForexFunds

FTMO is another prop trading firm and a direct competitor of My Forex Funds, hence their comparison is obvious.

FTMO also has 4.9 stars rating as My Forex Funds on Trust Pilot. But generally, experienced traders give more preference to FTMO.

Considering trading challenges and rules, FTMO has a better impression compared to MyForexFunds.

Should I Join My Forex Funds?

As of now, My Forex Funds seems legitimate as it pays the percentage profits as disclosed in their earning plan.

Most people are earning well using their trading skills with My Forex Funds. However, My Forex Funds is slight new to the industry and have some flaws to deal with.

We suggest examining it at your personal level. Understand the targets and policies of My Forex Funds.

Simultaneously, one can also check for other options such as FTMO, Topstep Futures, Earn2Trade, etc.

Read: Entre Institute Review

hey, can cryptocurrencies be traded on MFF?

Thanks

Karol

Stay far away from this broker, they will restrict you for no reason and reduce your leverage. I love their benefits but once you receive an email from them saying that you are restricted, they will never help you trade with them again. I think they take advantage since they have a lot of clients.