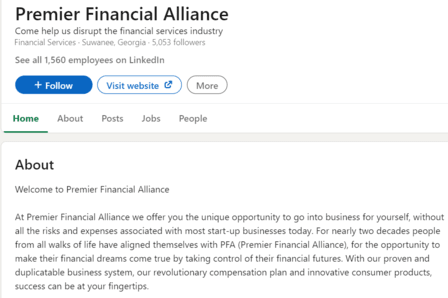

Premier Financial Alliance has been operating in the market for years with claims of offering new opportunities for individuals who want to operate their businesses without any risks.

In this post, we will review Premier Financial Alliance and explain whether Premier Financial Alliance Pyramid Scheme or not.

| Founder | David Caroll |

| When Started | 2020 |

| Head Office | USA |

| Opportunity Type | Life Insurance |

| Website | Pfasuccess.com |

| Joining Cost | $125 |

Jump To ⇢

What is Premier Financial Alliance?

Premier Finance Alliance aka PFA is a MLM-based insurance company that believes in one product, multiple solutions.

The founder and CEO of this company is David Caroll. The headquarters of this company is located in Suwanee, Georgia, USA.

According to SimilarWeb, the total number of visits on its website is 48k+ with the top country reaching the USA (99%). And, its domain was registered on August 2020, as per WHOIS.

Read: BitSports Review

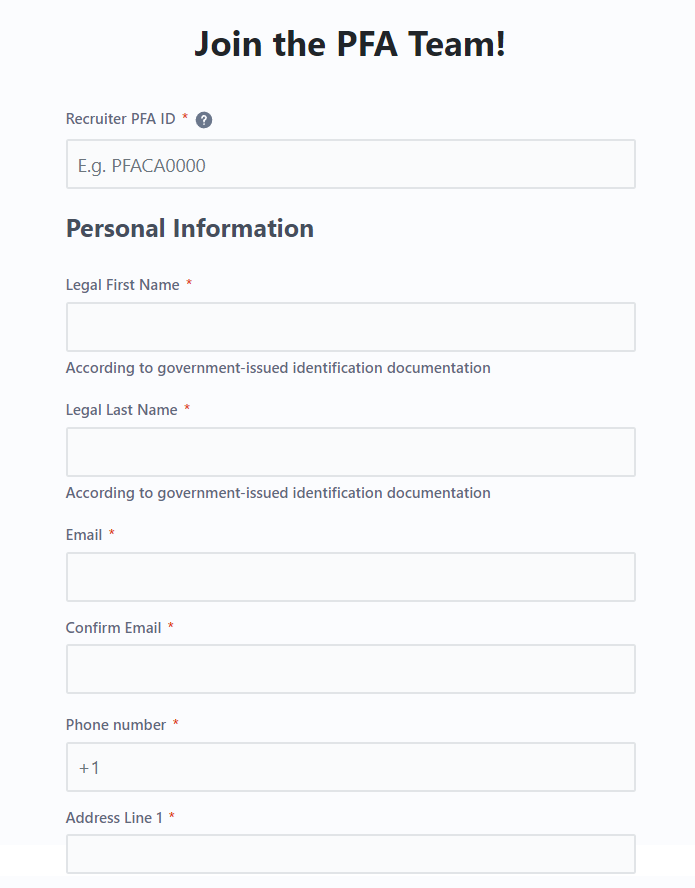

PFA Joining Process

The minimum joining cost to join PFA is $125 which allows you to become a part of the PFA affiliates program

You just have to simply sign up on their website by providing basic details of yourself to join PFA.

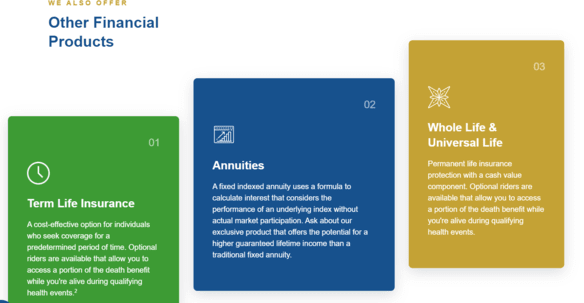

PFA Products

Although PFA considers only one product as the major concept of the company they still of 3 other financial products or services:

- Life Insurance (for a predetermined time)

- Annuities

- Whole Life Insurance (permanent life Insurance)

Read: Unicorn Ultra Review

PFA Compensation Plan

There are several ranks in the PFA affiliate program and two tracks to reach any rank.

One is “Builder Track” and the other is “Personal Track”:

- Builder’s Track qualification relies on the volume generated by a downline.

- Personal Track qualification relies more on an affiliate’s activity.

The requirements for ranks in both criteria are:

| Ranks | Builder Track | Personal Track |

| Career Associate | Recruit 3 affiliates and generate 9000 points | Recruit 3 affiliates and generate 9000 points |

| Field Associate | 25k GV in downline and recruit 3 affiliates who recruited 3 | Recruit 3 affiliates who recruit 3 affiliates within 30 days |

| Senior Associate | 50k GV in downline and Recruit 5 affiliates who recruited 3 | Recruit 5 affiliates who recruit 5 affiliates within 30 days |

| Provisional Field Director | 75k GV in month with downline generating 30k in a month | Generate 10k PV |

| Qualified Field Director | 100k GV in month with downline generating 30k in a month | Generate 320k PV |

| Senior Field Director | 150k GV in month with downline generating 30k in a month | – |

| Regional Field Director | 250k GV in month with downline generating 30k in a month | – |

| Area Field Director | 350k GV in month with downline generating 30k in a month | – |

| National Field Director | 450k GV in month with downline generating 30k in a month | – |

| Executive Field Director | 750k with downline generating 30k in a month | – |

Here the GV means group volume and the PV means personal volume. Note that in the Personal Track you can only reach up to the Qualified Field Director after that you have to go through Builder Track. Besides that, Target Point isn’t defined yet by the company.

Moreover, all the ranked affiliates earn commissions on every newly recruited affiliate as described in the table below:

| Ranks | Commission |

| Career Associate | 35% |

| Field Associate | 45% |

| Senior Associate | 55% |

| Provisional Field Director | 60% |

| Qualified Field Director | 70% |

| Senior Field Director | 75% |

| Regional Field Director | 77% |

| Area Field Director | 79% |

| National Field Director | 81% |

| Executive Field Director | 83% |

There is also a Residual Rescue Commission and Renewal Grid in PFA which begin at Qualified field rank. However, there is no information provided about the Renewal Grid component.

| Ranks | Level 1 | Level 2 | Level 3 | Level 4 | Level 5 | Level 6 | Renewal Grid |

| Qualified Field Director | 8% | 5% | 3% | 2% | 1% | – | 1.5% |

| Senior Field Director | 13% | 10% | 8% | 7% | 6% | – | 1.75% |

| Regional Field Director | 15% | 12% | 10% | 9% | 8% | 2% | 2% |

| Area Field Director | 17% | 14% | 12% | 11% | 10% | 4% | 2.25% |

| National Field Director | 19% | 16% | 14% | 13% | 12% | 6% | 2.5% |

| Executive Field Director | 21% | 18% | 16% | 15% | 14% | 8% | 2.75% |

Read: The Real World Tate

Premier Financial Alliance Review

After analyzing this Premier Financial Alliance’s business model and compensation plan, we found several precautionary signs. Let’s take a closer look:

No Transparency

Its compensation plan has an excessive amount of complicated terminology that is not sufficiently explained. Terms essential to determining how much an affiliate will earn aren’t described.

Any business should avoid using this methodology because it could result in potential fraud against its clients. This is a critical characteristic of MLM companies to improvise.

No Product Description

The absence of information regarding this company’s products and services should raise serious concerns.

They have just mentioned life insurance as one of their financial services; they haven’t gone into detail on how it is structured, the duration of the life insurance, or any other relevant information. It is vital to avail more information on their public website.

Suspicious past

Many of its affiliates filed a lawsuit against PFA in April 2023 for alleged violations of Californian law. Affiliates claim that PFA controls purportedly “independent” business owners while claiming that PFA distributors have independent contractors.

These things produce great skeptical thinking among its users and target audience and also decrease trust too.

False Claims

The company has stated on its social media page that they are operating for more than a decade in the market but its domain was registered in 2020. Well, it’s possible that they changed their domain, but their website has no mention of that.

These facts clearly show that they are concealing something while aiming to mislead individuals via their new domain.

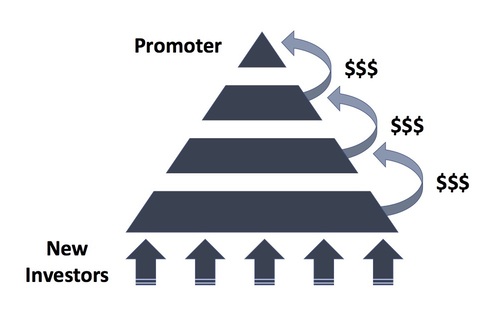

Money Circulation Fraud

Despite declaring on its website that they aren’t a pyramid scheme; we can state with absolute certainty this firm is nothing more than a sophisticated pyramid scheme. its compensation plan is direct proof of that.

In these kinds of schemes, the owners and founders only receive a sizable portion of the profits, while the other clients receive nothing.

LegalShield and American Income Life are two other similar companies that fail to deliver the right products to consumers and focus more on making profits with the MLM scheme.

Should I Join Premier Financial Alliance?

This decision is completely up to you. Nowadays, the insurance market is extremely competitive. Due to the involvement of the Internet in this sector, it has become more saturated.

Hence participating in an MLM company selling insurance seems a tough decision, as it already has a bad reputation and a very low success rate.

Therefore make wise decisions and don’t be influenced by cheap motivation.

Read: Lyconet Review