Tranzact Card, a financial service provider offering both physical and digital transaction cards bearing the globally recognized Visa brand, has recently found itself in the midst of a significant crisis.

As Start of September 2023, the company has lost access to its US banking processors, raising concerns about its future viability.

The Visa cards associated with the TranzactCard were acquired through Evolve Bank and Trust N.A. and CBW Bank, with Solid Financial Technologies also playing a role.

TranzactCard Lost US Banking Services

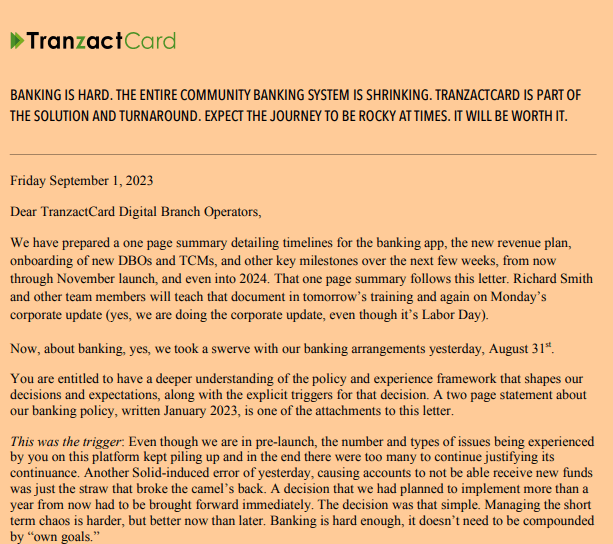

TranzactCard acknowledged the banking issues in an email sent on August 31st, stating that customers were unable to fund their TranzactCard accounts due to problems with their banking platform provider.

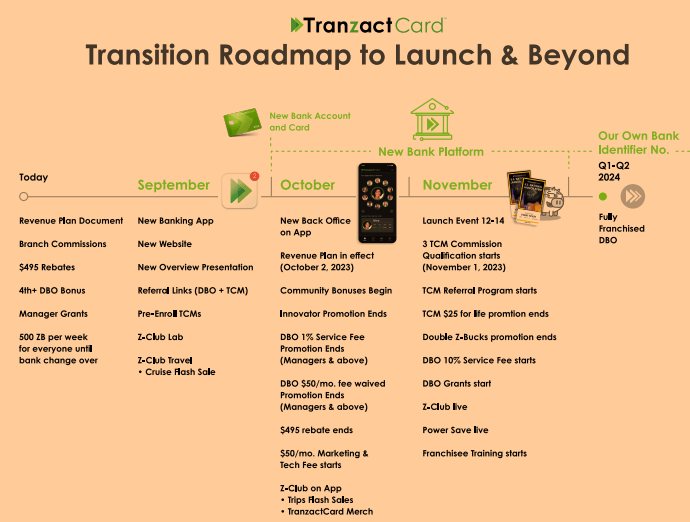

On September 1st, TranzactCard suddenly announced that it was transitioning away from its current banking platform and setting up its own program with one or more direct community banks.

This transition, originally planned for 2024, was expedited due to the strain caused by the shared bank identifier with other fintech clients.

Read: Minerlands.App Review

Why TranzactCard Lost Bank Services

While the root causes of TranzactCard’s banking crisis remain unclear. While it has been suggested that compliance issues could be a common reason for companies losing access to banking services, TranzactCard placed the blame squarely on its partner, Solid Financial Technologies.

TranzactCard has claimed that it had experienced an array of issues while working with Solid, which had become unsustainable. They cited a recent error that prevented accounts from receiving new funds as the catalyst for their abrupt decision to transition away from the existing platform.

TranzactCard confirmed to its affiliates that their Visa cards would remain functional for outgoing payments and withdrawals but later sent another email stating that all active accounts and bank cards would be closed at the end of September and not transferred to the new bank.

Read: Sparkon.shop Review

TranzactCard New Banking Channels

TranzactCard emphasized that the transition process would take several weeks, during which regular updates would be provided. The specifics of the new banking channels, whether they will be US-based or offshore, are yet to be revealed.

As the November 12th launch date approaches, TranzactCard affiliates are awaiting further updates and hoping for a smooth transition to the new banking channels.

Read: Henbbo.com Review