In today’s digital age, online fraud has become a prevalent issue that affects millions of people worldwide. Whether it’s a phishing scam, identity theft, or unauthorized transactions, falling victim to online fraud can be a distressing experience.

Whether it’s a fraudulent purchase, identity theft, or a scam, victims often find themselves in a frustrating situation, seeking ways to recover their lost funds.

There are steps you can take to get a refund and minimize the impact of the fraud.

In this post, we will discuss various approaches to getting your money back after online fraud.

Jump To ⇢

Ways to Get Money Back After Online Fraud?

With the right approach and proactive steps, it is possible to obtain a refund after online fraud.

Here are some most common online scams and a guide on how to get a refund from a scam.

1. Beware of Recovery Scams

It is common for criminals to contact their victims after stealing money, pretending to be their bank, the police, or money recovery experts.

These recovery scams aim to steal more money by asking you to move funds into a “safe” account or tricking you into sharing information that enables further crimes.

To protect yourself, never trust any communications by phone, email, or text. Instead, call the organization directly and verify if they tried to contact you.

2. Report to the Cyber Cell

The first step in dealing with online fraud is to report the incident to the Cyber Crime Police. It is important to do this as soon as possible to obtain a crime number, which will be required when working with your bank and other organizations.

In most cases, you can report online scams and cybercrimes to organizations like Action Fraud.

3. Contact your Bank

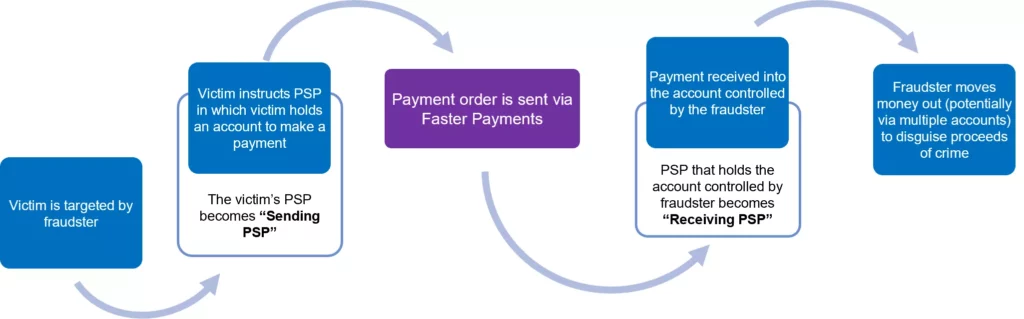

After reporting the fraud to the police, it is essential to contact the financial organizations involved in making the payments. If the fraudulent activity occurred in your bank account, reach out to your bank and explain the situation.

If you know which bank the money was sent to, contact them as well. Acting quickly can help freeze the money if it is still in transit and initiate a fraud investigation.

Additionally, tools like Cybera allow you to make a global report to freeze the money as soon as possible.

The process of getting your money back after online fraud depends on how the money was stolen. Here, we will focus on these different approaches:

4. For Authorized payments (Tricked to Make Payment)

If you were tricked into making a payment, most banks have signed up to a voluntary code on how to handle payments made to scammers.

This code ensures that banks cannot dismiss victims’ claims but must investigate and determine if they adequately protected you from making such payments.

The process involves reporting the scam to your bank’s fraud team, which will initiate an investigation. The bank has 15 days to investigate and provide an outcome.

The possible outcomes are full reimbursement, no reimbursement, or 50% reimbursement, depending on the bank’s duty to protect you. If you do not receive full reimbursement, you can make a complaint to the Financial Ombudsman Services.

5. For Unauthorized Payments (Criminal Carried Out Payment)

If a criminal carried out a payment using your accounts without your authorization, the Financial Conduct Authority has rules on how banks must handle such situations.

You should be able to get your money back if the payment was made within the last 13 months, the bank cannot prove your authorization, and you did not act with gross negligence.

The process is similar to the authorized payments approach, involving reporting the fraud to your bank’s fraud team and initiating an investigation.

6. Impersonation with the Financial Organization

In cases where a criminal has used your personal data to impersonate you with a financial organization, such as taking out a loan or credit card in your name, it is crucial to seek help from resources specializing in identity theft.

They can guide you through the process of resolving the issue and recovering any financial losses.

7. Credit/Debit Card Fraud

If you made a payment using a credit or debit card, there are specific protections in place. Credit card purchases between £100.01 and £30,000 are protected by Section 75 of the Consumer Credit Act 1974.

This means that if you were tricked into spending on your credit card, you can make a Section 75 claim to request a refund. It may also be possible to dispute a payment worth less than £100, depending on your credit card provider.

To get a refund, contact the company or bank that issued the credit card or debit card and explain that it was a fraudulent charge. Ask them to reverse the transaction and refund your money.

8. Unknown Payment from Account

If there is an unknown payment from your account or if you’ve bought something from a scammer, contact your bank immediately and explain the situation.

They may be able to reverse the transaction and refund your money. If you’re not satisfied with how the bank handles your claim, you can file a complaint with them and, if necessary, escalate it to the Financial Ombudsman.

9. E-commerce Scam

If you paid by card or PayPal and haven’t received the goods or services you purchased, you can request a refund through the chargeback scheme. If you paid by credit card and the item cost more than £100 but less than £30,000, you may be eligible for a Section 75 claim.

For payments made with cryptocurrency or cash, the options for refunds may be limited, but it’s still worth contacting the relevant companies or authorities to report fraudulent transactions.

To detect an e-commerce scam, you can check the website’s trust score on the Safety Checker Tool.

Remember to stay awake, monitor your accounts, and seek assistance when needed. By taking these steps, you can regain control over your finances and protect yourself from future online fraud.

Read the following guide to detect and avoid online scams in the future.

Do you have any advice for scams involving Crypto?

Pls help me with this Clinique,they are Carry all my money pls

Am învestit în ufinacapital.pro in data de 16 octombrie anul in curs,mi sa activat aplicația petru asta doar două trei zile,a crescut investiția cu un procent minim și în prezent aplicația este închisă de pe 20 octombrie și banii mei sunt in balance…nu pot să îi retrag de aici…am rugămintea dacă cineva poate să mă ajute să îmi recuperez banii, mulțumesc

I invested with hertzu and I lost my money? Can I get my money back please needs your help 😭😭

M.nnasdap.com

It is SCAM

BGFT token

I made orders on August 26, 2023 and paid for them on Aug 26,2023 Caranly http://WWW.PONCERT.COM

Order No. 00054928, Order No. 00054953, Order No. 00054965

buy one get one free

When will I receive my orders and where are the free beds?

order and payment in the application

Is Caranly.com legit?

We found Caranly.com a risky website.

From where Caranly.com is operating?

Caranly.com’s server located in Shenzhen, China.

When Caranly.com started?

Caranly.com domain name is registered on 05, June 2023.

Is Caranly.com down?

The last time we checked on 27, September 2023, Caranly.com was accessible.

Is Caranly.com safe?

According to our algorithm, Caranly.com have the safety score of 0 out of 100.

have money on Zoompgs.com, can’t withdraw, use caution this website

Have money on coagiva can’t withdraw

Please be caution

Hello, has anyone received credit from sumpactopay.com. I pay taxes, the loan is not transferred, but they send new taxes again. Is this normal or have I fallen into the hands of scammers?

Please is pacminer safe to invest.

anyone who gets lured into employment by webcenter.site kindly do not even try it… the site requires you to open an account with them..webcentre.site and activate your account with crypto or bitcoin from legit accounts such as bitget or binance and once you transfer your coins to their sites they randomly assign you commissions and you have imaginary tasks that you have to do and you have to keep topping your account with more coins with your real money so that you can at the end withdraw it with the commissions that you have earned with them, twist is this number keeps tripling and before you know it, you now owe them money and they are threatening to contact schufa and recover monez from you.. kindly avoid any lure of a digital marketing job originating from webcenter.site

I made payments via Binance on this site http://decentralizedfinance1.com, a total of 35,000 USDT but they are blocked and I can’t withdraw them, I’m sure it’s a scam, what should I do? Thank you

I have lost the money on montinexchange website please help me kindly

Habe bei Shopify Geld eingezahlt und bis heute nichts zurück bekommen

https://tetherusglobal.com/ scam!! dangerus

Why do widthrawal delay after widthrawal date

I invested 105Usdt in montinexchange.,

But now they Want me to add on 311usdt in order to to withdraw

Please Any One CAN tell me how to gain back my 105usdt

I invested with https://forexleaguecapitaltrd.com/crypto. Every time they promised to pay back and I deposited, they want more and more. In the end there was no withdraw at all

Salve io ho investito su colmex 247.io a luglio ,poi ora che siamo con conto positivo e tt le operazioni chiuse mi chiedono il 10 per cento sul guadagno ,io non ho inviato nie te chiaramente,e poi ora sono spariti ,non rispondono più ,colmex347.io attenzione ti sono amici finché metti soldi poi,basta ,mi hanno bello e che truffato

Witam posiadam pieniądze na wandpocket2.cc niemoge wyplacic swoich środków chcą bym wpłacił swoje 3500 usd abym mógł wyplacic swoje srodki jest ktoś kto jest w stanie mi pomóc z wypłata tych środków potrzebuje pilnej pomocy powinien prawidłowo wyplacic mi 7000usd byłem już z tym na policji ale nikt mi nie jest w stanie pomóc policja mówi że to są nikłe szanse bym mógł to wyplacic proszę was o pomoc 🙁

Do not deposit in BTCC.US. They stole my money. I had to go thru bitflyer and trust wallet. When I transferred it to BTCC.US I could not get any back until I paid IRS taxes on all my profits. Which I knew then was a scam, but too late. Anybody know anyway to get money back. Was led on by Maria Carter from Miami. Con artist!!!!!

Pour moi c’est dans le cadre de l’arbitrage des cryptomonnaie, j’ai effectué un premier dépôt de 200usdt dans le site vaultocrypto.net et pour le retrait, on m’a demandé de faire un autre dépôt de 100usdt, ce que j’ai fait. Malheureusement, le site a bloqué mes fond et je n’arrive pas à faire le retrait. A chaque fois, lorsque j’essaie de faire le retrait, on me montre que le retrait est bloqué. J’aimerais savoir s’il ya possibilité de récupérer mes fonds

Please avoid Whats99. com a high scam zone, requesting for 30%personal income tax. After payments have been made, accounts are frozen and no withdrawals. Plugs; Pratt, Pete , walker, Ryan, Lisa.

hey guys please be careful with one of this website ( https://www.CoinW.trader.com) mostly they are likely tell you do trading with them after you transferred all funds to their platform all your money will froze and can not withdrawal .

thanks

Bitmake.trade is it a scam. Put 1 k in bitcoin now they want more for me to be vip to be able to withdraw my money. Still can’t withdraw and no help from support won’t even answer. Any way to help

Hello,

I have Money in the Crypto Bank, cb-online.group. I asked a withdraw from 89490€after that I had to pay 4300€ VAT from Arbian Emirates after that 5369€AML tax. This was all aranged by AUDITEMSA In Sierre, Switzerland.

Now they are telling me that I have to open an offshore account in Liechtenstein to have my money back and I have to put 7500€ on this account but I have to put this first on the Crypto Bank. I think this is one great scam.

Is there somebody that know the names Crypto Bank CB-online Group or AUDITEMSA? Please is there anyone who can help me?

Thank you in advance, best regards.

A company named GYNBLL,COM took $1,00 then $80.00 out of my account and I have no idea what it is

I have play games on betcolumbus and I can’t withdraw the money sir it’s about 600000$

https://custodyubtc.com

This is a scam site I bought vip1 and vip2 and vip3 and vip4 and vip5 and lost all assets but they didn’t allow me to transfer and blocked me.

I got scammed by the following website Xdzqsalefskk.shop. They contacted me on telegram then tricked me and took my money. Beware of these frauds.

qkxmall.com is scam web site i loss $10000 usdt i need halp place i need to return my money

https://www.okwxbit.com/h5/#/

This is a scam website. When I wanted to withdraw my currency, I was told that I had to pay 10,000 USDT as a blackwashing deposit.

A web Idreamlimited.com is scam com taking my 732 usdt through Binance

kamaru sorry me too that take my 400 usdt and told me to add more in order to withdraw

Bom dia! Enviei 20000 usdt para a plataforma dfcoinpro.com sediada nos Estados Unidos , para negociação de btc , obtive lucros e agora disse que preciso depositar 15% de impostos para fazer retiradas, acho que e uma farsa , o que devo fazer para recuperar o meu dinheiro.

Notture.com is a fake site. I placed an order an they did give me a tracking number. It took a month to supposedly get here. Then they said it was delivered and signed for. I have cameras. I did not receive anything. Nor did my Neighbor’s. They offered a 60% refund for a “lost” package, now they are offering 90% saying that it was a scetchy courier. 😬 total scam!!

Buyersfactory is also a scam. After depositing 6000 according to them i made up to 30000 after purchasing from their merchants but till now I’m unable to withdraw

Pls help me Get back my money from one Buy factory life pls help me half a million pls

Really?

How? Have you cashed out before?

Buyers factory is real please. I know i posted it was a scam site, but the fault was from me, i didn’t fill the details correctly, but the manager helped me out and i was just created. I’m sorry i said that about buyersfactory

I lost money around 1000 usdt in Idream account please help me