This post is going to be a QZ Asset Management Review, a company that claims to provide MLM benefits with up to 3.5% returns weekly.

Here we will discuss the QZ Asset Management company profile, MLM compensation plan, as well as our personal review of QZ Asset Management.

At last, we will also share our answer to the question, Should I Join QZ Asset Management?

| CEO | Blake Yeung |

| When Started | 2019 |

| Head Office | China |

| Opportunity Type | MLM |

| Products | Financial Investment |

| Website | Qzinvest.com |

| Joining Cost | – |

Jump To ⇢

What is QZ Asset Management?

QZ Asset Management is headed by its CEO Blake Yeung. This company offers MLM opportunities in the financial niche.

There is not much data about the process of investing and earning returns. It was named Qianze Asset Management and later rebranded to QZ Asset Management in around 2021.

QZ is mainly known as the AI-based investment scheme located in China and planning to set its office in Shanghai and South Africa.

However, we will discuss in detail whether the company’s claims are legit or not.

According to SimilarWeb statistics, major traffic to qzinvest.com is from South Africa (76.11%), Nigeria (21.51%), Moldova (1.24%), and Belgium (1.14).

Update May 5, 2023: QZ Asset Management Collapse, and investors are unable to withdraw funds.

Read: 12% Club Review

Joining QZ Asset Management

Joining QZ consists of a zero membership fee but a minimum initial investment of $100 to start earning returns.

Also, there are no retailable products, instead, the investors need to sell the membership to others and bring in more investors.

Read: CCBP 4.0 Review

QZ Asset Management Compensation Plan

There are mainly two ways to earn with QZ Asset Management: Return on Investments and Downline Commissions.

1. Return On Investment

There are mainly two different return percentage plans prepared on the basis of the amount invested by the affiliate.

- QZ Basic: Requires to invest between $100 and $900 to receive a return of 1.75% per week.

- QZ Elite: Requires to invest $1000 or more to receive a 3.5% return per week.

However, some penalties are also applied while withdrawing money from the affiliate account. These are as below:

| Withdrawal Days | Penalty |

| Within the first 30 days | 50% |

| Within 31 to 60 days | 25% |

| Within 61 to 90 days | 10% |

2. Downline Commissions

There are mainly two ways to earn QZ Asset Management commission: Referral Commission and Rank Achievement Bonus.

A. Referral Commission

When affiliates add someone to the downline, they stay eligible to receive a 10% amount from the invested fund of each downline member.

B. Rank Achievement Bonus

There are mainly 5 ranks as per the QZ Asset Management compensation plan. On achieving ranks there are gifts as below:

| Rank | Required Total Downline Earnings | Bonus |

| Rank 1 | $3000 | $500 |

| Vice President | $6000 | Samsung Galaxy S22 |

| Senior Vice President | $20,000 | Rolex Datejust |

| Executive Vice President | $50,000 | Rolex Submariner |

| Director | $1,50,000 | Mercedes-Benz GLC |

Read: Rupee4Click Review

QZ Asset Management Review

This was everything basic about QZ Asset Management. Still, we have much more to discuss.

Before you invest your hard-earned money in any such company, make sure to go through the review of the same.

Let us have a detailed look over a few warning points or major red flags about the company.

False Claims

As we can see in the image, QZ Asset Management claims to be in the finance industry for 10 years.

However, the company is only active since 2019. First with the name Qianze Asset Management and later rebranded as QZ Asset Management.

Even their address seems fake and QZ’s Facebook page is actually managed from Singapore.

The CEO Blake Yeung and the organization itself have very less presence on social media platforms.

Securities Fraud

QZ Asset Management claims that it is registered with AMAC (Asset Management Association of China). AMAC is a self-regulatory association, hence their approval doesn’t matter for an international investment company.

In China, such investment companies need to be registered with China Securities Regulatory Commission which it doesn’t have.

So eventually QZ Invest is doing securities fraud, as companies are required to have approval from financial regulators of different jurisdictions for operation. Whereas, QZ Asset Management is failing to provide basic details.

QZ Asset Management has most investors from South Africa, hence they need to get approval from Financial Sector Conduct Authority (FSCA) to operate this investment program.

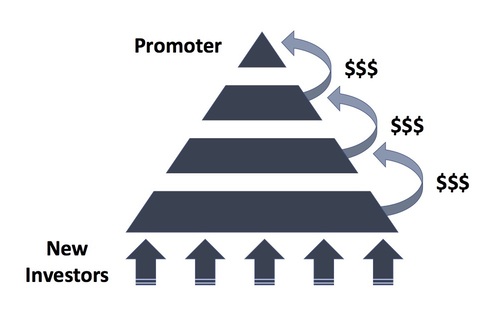

Money Circulation

Up to 3.5% guaranteed returns in a week is not possible in a real-world scenario, but QZ Asset Management is promising this.

QZ says their BDAI technology (Big Data and AI) generates profits for them. Then why do they need money from small investors around the world?

They can double their own money in a few months and earn profit for themselves without any risk. But the reality is far away from this. There is no AI technology or investment strategy they use to make guaranteed returns.

QZ Asset Management’s compensation plan is based on bringing more people to the company rather than generating profits from other business activities.

It can be seen that money flows by simply recycling the newly invested funds and paying the old investors as returns.

As a result, it can be said that QZ Asset Management is a money circulation Ponzi scheme that may collapse soon taking away all the hard-earned money of people.

Read: PLC Ultima Review

Should I Invest in QZ Asset Management?

We do not suggest being a part of a company that is not even legit and makes false claims regarding its existence.

For now, QZ Asset Management may pay their investors, but it is part of their strategy to make investors fool and win their trust. Later on, QZ Asset Management will lock the money of investors and disable withdrawal.

Eventually, many people will lose their hard-earned money for this guaranteed return scheme.

Such companies prove to be money circulation schemes, Hence stay away from such fraudsters.

Read: Forsage BUSD Review

your review has no meat and you cant even give the correct info on compensation plan. QZ offers two packages: Basic .> From $100 to 900 gets 3,5% weekly while the Elite package from $1000 to 25000 gets 7% weekly a whooping 1% daily and its withdrawable anytime after its Monday pay out. And another mistake aside from the ROI, Brokers Program where investors gets 10% on every referral as affiliates fee and a binary bonus of 10% for every pair in their network. The majority of earnings of QZ investors is when they convert their Investment into PRE IPO shares which is valued today til April 15 @ $1 by its opening in NASDAQ in August 2023 its opening price is $5 so with an income capacity of 400% every small investor who made as low as $100 can gain x20 on their investment, This is games of the big boys … which obviously u dont belong

AlphaAnj

And what about their legalities? crucial information they hide and false claims? Is the ROI figures justify their tendency to scam people?

Legalities are all done with due diligence. Go to SEC GOV and NASDAQ check QZAM and when theyre gonna go public in US. Theyre in 8 countries goin 9 as theyre opening the 2nd office in Johannesburg. Capital Investment and Asset Management are same most banks n insurance companies have their own. Its for the ultra rich and be thankful bec with the platform of QZ its now being copied by other like companies. Opening it to retail investors.

BTW when one is with AMAC it means its regulated by the top 2 regulated securities of China. QZ even uphold the highest standard.

When a company is busy planting new offices they dont have time on responding to non sense half truths. Go inside the back office its free anyways 😂 until ur confidence is strong that u wanna fund it on your own no xferring of funds to anyone.

You’re a top scammer Hermant. Stop telling lies.

AlphaAnj,

Your first mistake is that you are too quick to talk about the monies people will earn and not the business itself. Many of those like you, who are quick to defend don’t look at the legalities.

Firstly an IPO can be rejected by the US SEC, and just because they registered doesn’t mean they are legit. There are no financial docs on that SEC domain that show exactly where the investor funds go (don’t tell me about commission), the product is more important. They are not registered with any finance regulators!

On top of those shenanigans, I have only seen the operation of their so-called BDAI trading bot once…are you people selling the product or referral?

Just like Omega pro, it will vanish once recruitment reduces and you will find out they can’t bail themselves even with their AI prowess. All Ponzi scheme got an expiry date. Show concerned for the those that will get their savings burnt.

I RESPONDED to the posers first mistake in his post… Half truth is no truth at all.

When one is with AMAC its already automatic that this association is regulated by the top 2 regulatory board of China, it doesnt have to specify it. Duhhhh

Mistakes in one’s statements shows he hasnt experience going inside and is reacting on infos gathered thru non reliable source. And has no Accounting or Financial course background. Its merely opinion of a limited minded fearful person who isnt a risk taker.

BOTTOM LINE, when it comes to investment…

*Are they paying? ABSOLUTELY.

They have IRP (Intl Recognition Program) in addition to their Brokers Program (10% Affiliates fee and another 10% Team income)

Are they giving those additional incentives like the Porsche Palmera last IRP2- Absolutely the car or its cash equivalent $130,888 🥰

IRP3 – is a Ferrari Supercar or $500k- 4 already qualified

*Are they giving away Iphone 14 Pro Max last Easter – ABSOLUTELY

*Are they giving USA luxury trip? ABSOLUTELY

*Are they giving Shanghai trip and for qualifiers to see the $20M BDAI robot where they have propriety rights- ABSOLUTELY

Many many more incentives for IRP3

Kindly get the inside story before a review is taken seriously or its just that… non sense.

They dont need your money they are already managing 50M yuan or $7.4B with a capital B

But theyre TRUE IN THEIR VISION.

“Creating Value Beyond Wealth”

BTW an Aseet Management solves problem.

World problem even those rooting from corruption results to poverty… And those saying negative about it being in Africa. They just solve one major problem and that made me fall in love with QZ doing the biz gives me a purpose.

I want to join QZ .

Visitor Rating: 2 Stars

Visitor Rating: 3 Stars

Visitor Rating: 2 Stars

As Form me What matters is when I invest and I get my breakeven and more back, then its fine. Keep arguing while we make money.

Visitor Rating: 4 Stars

Visitor Rating: 2 Stars

Visitor Rating: 3 Stars

Visitor Rating: 3 Stars

Visitor Rating: 2 Stars

Visitor Rating: 2 Stars

Visitor Rating: 4 Stars

Visitor Rating: 2 Stars

QZ management. a sustainable solution to poverty , it keeps us at the top where we belong, because the bottom is overcrowded. Every Mondays we get paid. isn’t that awesome , join it and stop feeding people with false information.

QZ is almost collapse, stop looting people..

Visitor Rating: 1 Stars

Legalities are all done with due diligence. Go to SEC GOV and NASDAQ check QZAM and when theyre gonna go public in US. Theyre in 8 countries goin 9 as theyre opening the 2nd office in Johannesburg. Capital Investment and Asset Management are same most banks n insurance companies have their own. Its for the ultra rich and be thankful bec with the platform of QZ its now being copied by other like companies. Opening it to retail investors.

BTW when one is with AMAC it means its regulated by the top 2 regulated securities of China. QZ even uphold the highest standard.

When a company is busy planting new offices they dont have time on responding to non sense half truths. Go inside the back office its free anyways 😂 until ur confidence is strong that u wanna fund it on your own no xferring of funds to anyone.

I have seen how people managed to invest and how the money was been transferred to the people who invested. But what is wrong with the website. Can the CEO address the people and let them know when is the website going to be upgraded.

By the way I just found this article today… I saw all these red flags mentioned on this article when I was already scammed.

It is true the Chinese has scammed African people and people have lost their lives due to monies they invested. It was announced today at 18:09 pm that the ceo has left without trace .

[email protected] if you need more information.

We have been advised that withdrawals will continue from 01 June 2023. But currently the system is off

We cannot access it right now and we have received no communication at all, must we be worried as investors?

Yes, QZ collapsed and its almost impossible to get investment back..

Visitor Rating: 5 Stars

IM ALSO AN INVESTER IN QZ SINCE APRIL 2023.. I HAVE INVESTED ABOUT 20,000 NAMIBIAN DOLLARS AND IM SO DISSAPOINTED TO HEAR ABOUT WHAT IS HAPPENING TO US RIGHT NOW. THE MONEY I INVESTED WAS MY LAST SAVINGS AND I THOUHT THROUGH INVESTING WITH QZ I COULD MAKE MORE MONEY FOR MY CHILDRENS EDUCATION , FOOD AND STAFF.. NOW MY QUESTION IS WILL I EVER BE ABLE TO GET BACK MY HARD EARNED MONEY , BECAUSE WRITE NOW IM SO DISSAPOINTED AND I DONT EVEN KNOW WHAT TO TO THINK ANYMORE WITH THIS WHOLE STRESS AND I TRUSTED THAT I COULD HAVE A BETTER LIFE WITH MY FAMILY BY INVESTING IN QZ…I NEED SOME ANSWERS and my MONEY back PLEASE.. IM FROM NAMIBIA, AFRICA …

Sir, its really disappointing to hear this from you. We have reviewed various such scams and saved hard-earned money of people around the world. But some morons always defend and promote these scams even after providing logical facts. You can check comments of this post only, how these fools pretend to be smartest.

Visitor Rating: 3 Stars

Visitor Rating: 1 Stars